Financial Wellness During a Pandemic

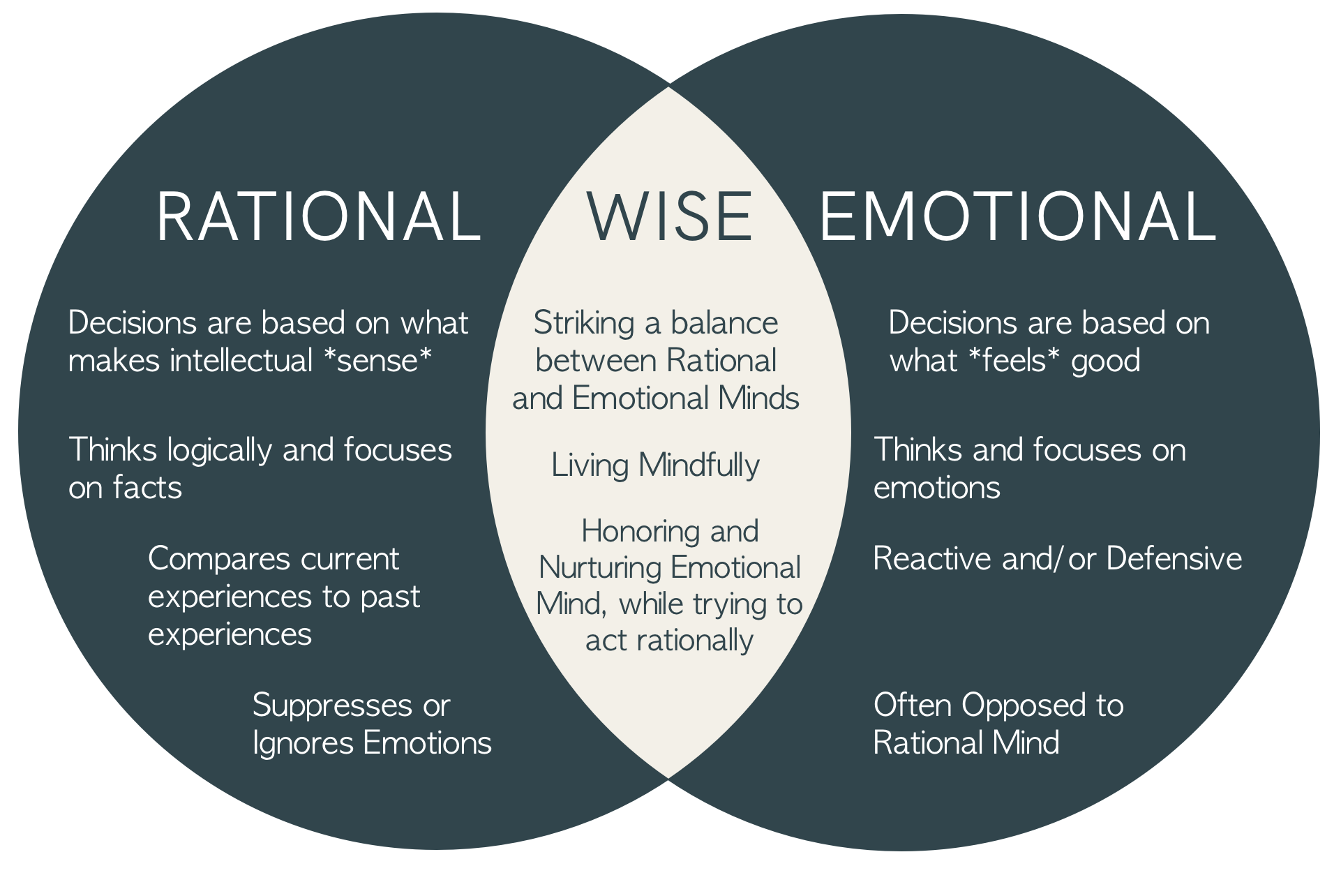

The Three Minds

Dialectical behavior therapy (DBT) offers this model for integrating the rational mind and the emotional mind. Here are the four levels of the financial wellness process and guidance for how to put your wise mind back in the driver’s seat.

Level One – Tracking

Paying attention to your money requires practice and invites you to be present with what is. Staying connected to your bank and credit card accounts is about turning the lights on, telling the truth and a willingness to be with potentially uncomfortable feelings. The practice of tending to your money is much like a meditation.

Level Two – Planning

Be proactive and map out what’s happening this month with your finances. You’re ahead of the game if you already have a spending plan. If you don’t have one, you’re not alone. More than half of Americans currently don’t have a budget (hence the historical divorce rates and financial stress related health issues). Money is an ever changing energy and you can direct the current and choose a positive mindset.

Level Three – Reflection

Pause mid-month and at the end of the month. Is your plan still balanced? Are you on track to end the month where you need to be? What’s going well with your money? Are there any boundaries you need to set or financial housekeeping tasks that would be supportive? Make any necessary adjustments to your spending, saving or earning while there’s still time.

Level Four – Integration

Practice having a beginner’s mind. Choose a financial confidant or find a money accountability partner. Continue learning and reading about money. You can set Google Scholar alerts on topics of interest to you, i.e. behavioral finance. Increased confidence, expanded financial consciousness, a sense of empowerment and more money will follow.

Money Affirmations

“I am capable of graining control.”

“I am hopeful about my financial life.”

“I am grateful for what I have.”

Right now, less is more. Taking care of your money is not always easy, but healthy habits can be learned and even mastered over time. You must engage your wise mind to create a sustainable relationship with money. You will have to come to terms with money for the rest of your life, so it is worthwhile to do everything in your control to make the experience peaceful, easier and even pleasurable. Enjoy the simple things and take good care.